2025 Maximum 403b Contribution Over 50

2025 Maximum 403b Contribution Over 50. Combined with the allowed employer contributions, the maximum is $76,500. Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

$23,000 (was $22,500 in 2025). — the 2025 403 (b) contribution limit is $22,500 for pretax and roth employee contributions.

2025 Maximum 403b Contribution Over 50 Images References :

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Max 403b Contribution 2025 Over 50 Tandy Florence, Determine the maximum amount that can be contributed to your 403(b) account in 2025.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Maximum 403b Contribution 2025 Over 50 Doria Odetta, — under the 2025 limits, the 403(b) retirement plan maximum contribution, as an elective deferral, is $23,000.

Source: stevenvega.pages.dev

Source: stevenvega.pages.dev

Max 403b Contribution 2025 Over 50 Tandy Florence, For 2025, the 403(b) max contribution limit is $22,500 for pretax and roth ira contributions.

Source: joshuahutton.pages.dev

Source: joshuahutton.pages.dev

Maximum 403b Contribution 2025 Joana Lyndell, For individuals under age 50, the maximum contribution to 401 (k), 403 (b), and 457 (b) plans increased to $23,000.

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

403 B Contribution Limits 2025 Over 50 Cathi Lorene, Combined with the allowed employer contributions, the maximum is $76,500.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

2025 Max 403b Contribution Limits Rea Kiersten, Determine the maximum amount that can be contributed to your 403(b) account in 2025.

Source: inezcallihan.pages.dev

Source: inezcallihan.pages.dev

403b Max Contribution 2025 Over 50 Nelia Wrennie, Determine the maximum amount that can be contributed to your 403(b) account in 2025.

Source: maxwelllandreth.pages.dev

Source: maxwelllandreth.pages.dev

403b Max Contribution 2025 Ilyse Leeanne, — on your end, you can defer up to $23,000 from your salary to your 403 (b) in 2025.

Source: caitlinmorgan.pages.dev

Source: caitlinmorgan.pages.dev

Max 403b Contribution 2025 Over 50 Tandy Florence, — the annual 403(b) contribution limit for 2025 has changed from 2025.

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

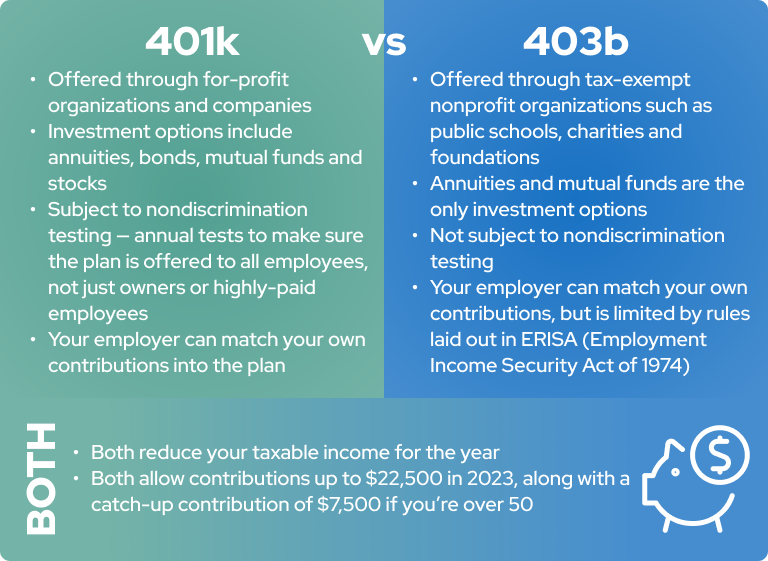

401k And 403b Contribution Limits 2025 Cristy Melicent, — discretionary or matching contributions from employers are permitted, up to a total combined maximum of $69,000 in employer and employee contributions for those younger than 50 in 2025.

Posted in 2025